Win better deals.

Give your RMs a continuous, real-time view into what is both impactful to the bank and actually achievable.

A quick & confident "yes or no"

Increase profitability via pricing

Andi® is our virtual insights analyst. She gathers data on what’s winning and what’s losing and delivers in-the-moment advice to help craft winning, profitable deals. She provides impactful coaching, in context and at scale.

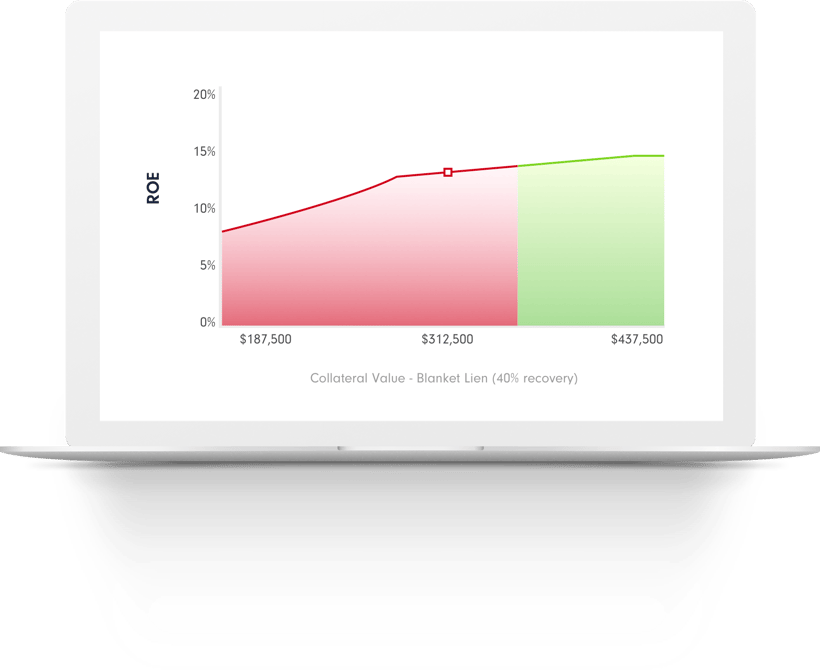

Andi suggests multiple pricing options to meet both the client’s goals and the bank’s return target. She flips the conversation from just rate and term to other possible structures such as amortization, term, loan to value, non-credit products or collateral.

Compete to win

Stop the race to the bottom by competing on rate and term alone. Andi suggests multiple ways to win versus your competition. She understands your competitive playbook, shows the full impact of the deal, so you can win valuable deals and leave unprofitable deals for the competition.

Know full relationship value

RMs instinctively know that one deal can solidify or jeopardize the client relationship but don’t always have the data needed to drive their deal structure decisions. Banks feed us the relationship information from core system to reflect credits, loans, deposits, and treasury services. PrecisionLender provides data to tell the full story, present options and show the deal’s impact on the relationship if it is won or lost.

Get a quick demo of PrecisionLender's powerful commercial pricing solution ›

Explore additional solutions

-

Andi Skills Builder

Have enhanced control over the sophisticated insights and coaching your RMs receive.

-

Market Insights

Market-level intelligence and coaching delivered in-the-moment by Andi, PrecisionLender's digital enterprise coach.

-

“We're no longer just talking about this loan or that loan. We're talking about relationships and customers.”

Andy Max

Managing Director, First National Bank of Omaha -

“Before, they had a model that they used as something to complete a hurdle or get out of the way. Now they have a tool that can help them do their job.”

Rich Padula

Director of Finance

See it in action

See why over 200+ banks worldwide use PrecisionLender to improve their profitability, growth, and client experience.