Proceed with Caution

Forbearance numbers are climbing and the outlook for the rest of 2020 is uncertain. Commercial banks must have a clear view of the risk already on their portfolio as well as in the deals they’re looking add.

Risk Levels & Bank Behaviors During COVID-19

As the ripple effects of the COVID-19 pandemic have permeated the U.S. and global economies, bankers have shifted their focus from concerns about waning loan demand and revenue challenges to dealing with the prospect of severe credit losses.

In this report, we took a closer look at the data, to get a better sense of how much risk banks are facing, and how well they’re adjusting to the changing conditions.

“We were overpricing better credit deals and underpricing poor credit deals.”

Several years ago, Richmond-based Union Bank (now Atlantic Union), brought on PrecisionLender to help them make sounder pricing decisions. Read on to learn their how lenders are having smarter discussions internally - and smarter conversations with clients - about the types of deals to pursue and the price they’re getting for the risk they’re taking on.

Mitigating Risk with PrecisionLender

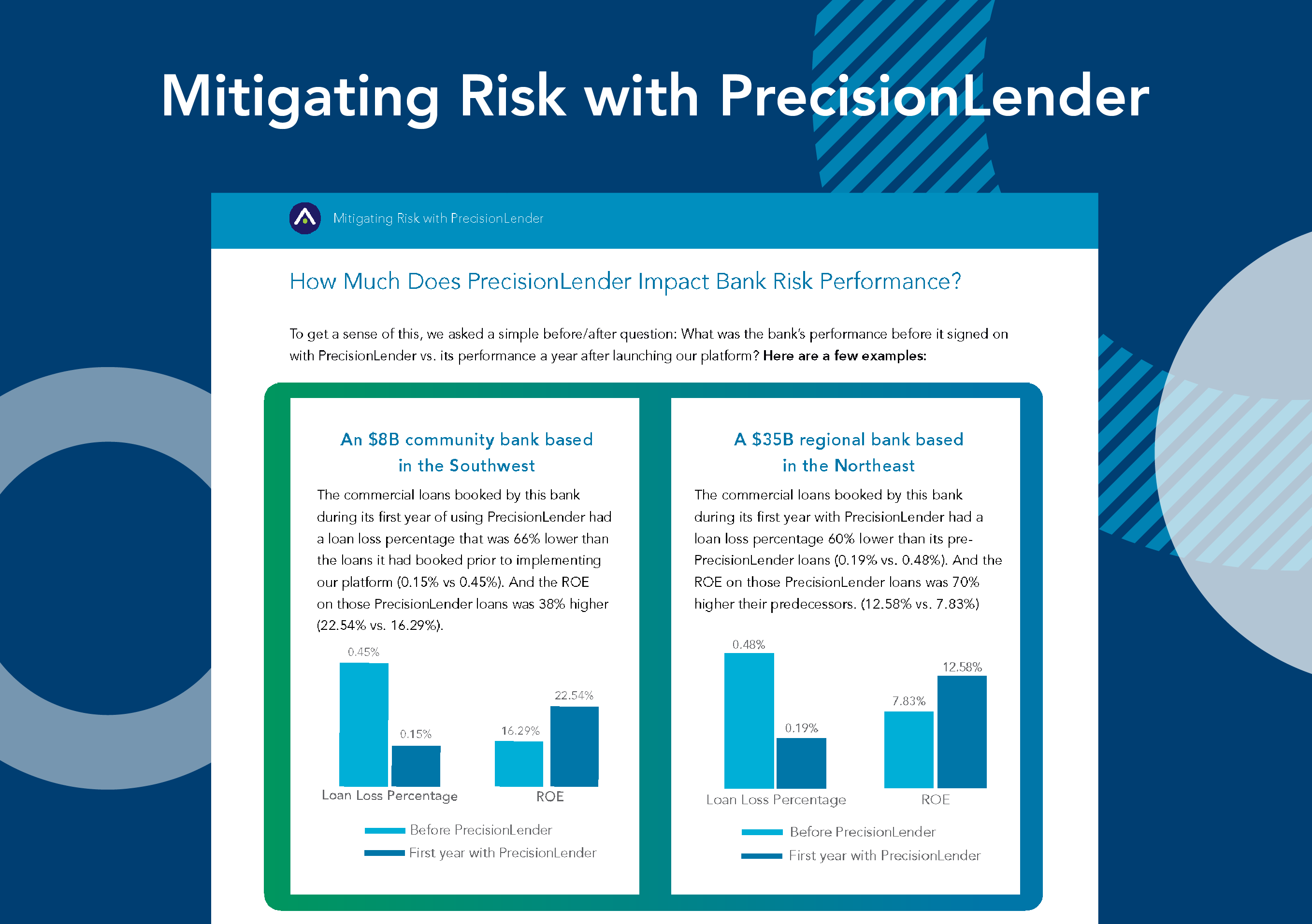

The events of 2020 have commercial banks intensely focused on risk. PrecisionLender clients are no different – but chances are they’re breathing a bit easier than their peers right now.

That’s because banks that use PrecisionLender have a track record of outperforming the industry when it comes to risk mitigation. And they're doing it while continuing to outpace their competitors in growth and profitability.

Your resources for mitigating risk

-

Product Guide

How PrecisionLender Helps Banks Price for Risk

PrecisionLender was built from the ground up to incorporate all forms of risk that a bank faces in a commercial credit transaction, and more importantly, to escalate the pricing process from one of simple calculations to true strategic steering of a balance sheet.

-

Market Report

Commercial Renewals: Market Best Practices

When renewing commercial deals, many banks leave basis points on the table or worse, increase their portfolio's risk exposure. Learn why, and how to improve your bank's renewal pricing in this report.

-

Article

Are Banks Taking a High-Risk Approach to Risk Mitigation?

Many banks are trying to reduce risk by only allowing senior execs to make all key commercial lending decisions. It's an approach that's actually fraught with ... well ... risk.

-

HOW-TO GUIDE

How to Steer Your Bank’s Portfolio Through an Economic Downturn

To survive (and thrive) during an economic downturn, your bank must monitor the right indicators, quickly adjust its portfolio strategy, and ensure that strategy turns into tangible action.

Get a handle on your bank's risk.

About PrecisionLender

PrecisionLender, a Q2 company, is modernizing commercial banking. Its sales and coaching platform empowers bankers with actionable, in-the-moment insights, so they win better deals and build strong, more profitable relationships. Andi®, PrecisionLender’s digital enterprise coach, augments banker strengths and intelligence with the latest technology and data, delivering the best recommendations at exactly the right time. 13,000+ bankers at approximately 150 banks—ranging from under $1B to over $1T in assets—use PrecisionLender’s solution. Set your bank apart with PrecisionLender’s applied banking insights.