Business hasn't stopped. Neither can your bank.

For banks on solid ground with credit, there are deals to be done. Businesses are still looking for funding. This period could be an opportunity to win market share for banks that can look to grow when many competitors are pulling back.

A Recession is the Time for Banks to Get Ahead

Economic downturns are usually a call for banks to batten down the hatches. But not banks that have an infrastructure that allows for quick responses to real, tangible effects that land on their balance sheet. With this agility comes opportunity. Instead of hiding to avoid any and all risk, these banks can proactively take market share when the competition starts passing on too many deals.

Steer Your Commercial Portfolio With PrecisionLender

Market conditions have shifted, and bank goals are changing, as a result. Now is time for your to analyze your portfolio, set a different course, and ensure that your front-line relationship managers take actions that align with your bank's strategy. Learn how PrecisionLender can turn these daunting to-dos into a reality.

Your digital transformation resources

-

Article

Four Questions Your RMs Should Ask About Their Relationships

Your relationship managers can't maximize the value of the deals they price unless they understand the full relationship. Here are 4 critical questions they should be asking about their relationships and how to protect them from the competition.

-

Success Story

First Midwest Creates a Cross-Sell Culture

Cross-selling is a central part of First Midwest Bank’s successful growth strategy. Learn how PrecisionLender helped First Midwest identify the impact of cross-selling on their relationships and adjust ROE targets to drive cross-selling behavior by their RMs.

-

Report

Measuring RM Performance: Proving Impact & Dispelling Myths

How valuable are your bank's top RMs? What do they do that produces better results than their peers? And how can you take what makes these RMs great and scale it to the rest of our sales team?

-

Product Guide

How PrecisionLender Helps Banks Understand Relationships

With PrecisionLender's Relationship Awareness functionality, bankers receive timely, contextual information on each commercial relationship's current and future value, as well as the impact it has on each deal.

Want more market share? We can help.

Learn how more than 200 institutions worldwide use PrecisionLender to price and structure winning deals that meet the needs of both the borrower and the bank.

About PrecisionLender

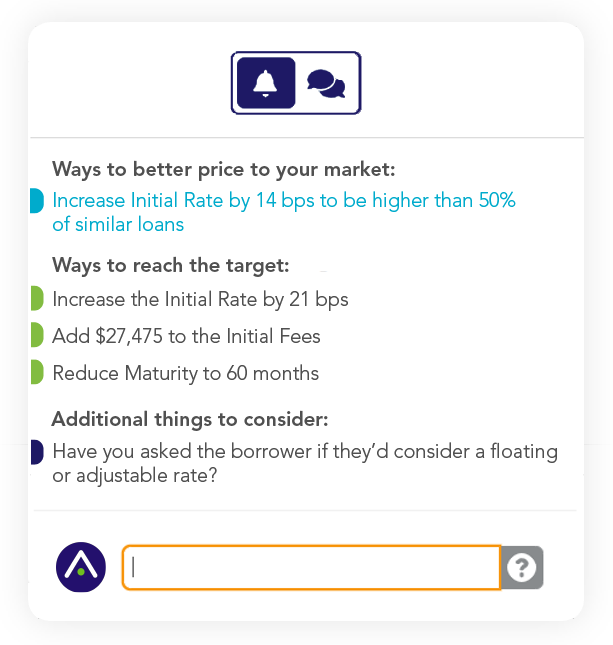

PrecisionLender, a Q2 company, is modernizing commercial banking. Its sales and coaching platform empowers bankers with actionable, in-the-moment insights, so they win better deals and build strong, more profitable relationships. Andi®, PrecisionLender’s digital enterprise coach, augments banker strengths and intelligence with the latest technology and data, delivering the best recommendations at exactly the right time. 13,000+ bankers at approximately 150 banks—ranging from under $1B to over $1T in assets—use PrecisionLender’s solution. Set your bank apart with PrecisionLender’s applied banking insights.

What our clients are saying

"Using PrecisionLender early and up front affords us the luxury, before we consume a lot of resources internally, to say, “Can we get the pricing that we need to meet our shareholder objectives?” If not, we’ll gracefully exit the situation."

Head of Wholesale Banking