We're Moving!

This site will close up shop on 08/28/2024. Click on the button below to go to our new location to find everything you need about the Q2 PrecisionLender suite of products and services.

No back room deliberation. No double checking. No convoluted spreadsheets. No expensive delays.

Software bankers use and love

If bankers don’t use the software, nothing else matters. Our solution was built for relationship managers, to enable better client conversations.

It gathers data without requiring time-consuming and redundant data entry. RMs know in the moment if each deal meets the terms of the bank and the client.

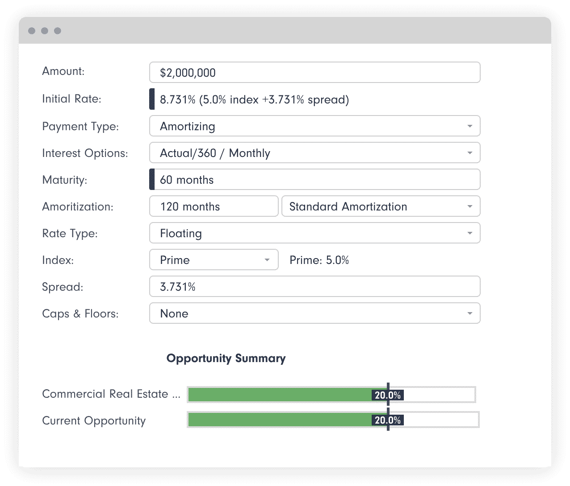

Structure and price to win

RMs make data-driven decisions as they craft personalized client scenarios and see 360 views of each relationship. They customize pricing assumptions and deal terms, compare options relative to the bank’s profitability targets and competitive offers. The result: profitable, winning deals that shape the relationship.

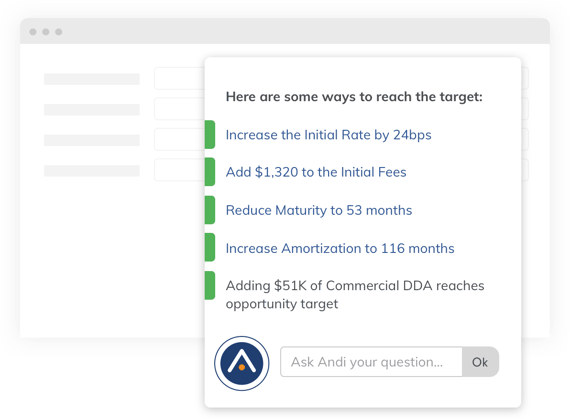

Right advice, exactly the right time

Andi®, our intelligent virtual analyst, works with RMs, observing their actions, gathering data. She delivers hyper-focused recommendations for this specific client, with this relationship, in this industry, in this market. She delivers suggestions at the moment of truth, when the deal is being structured and priced.

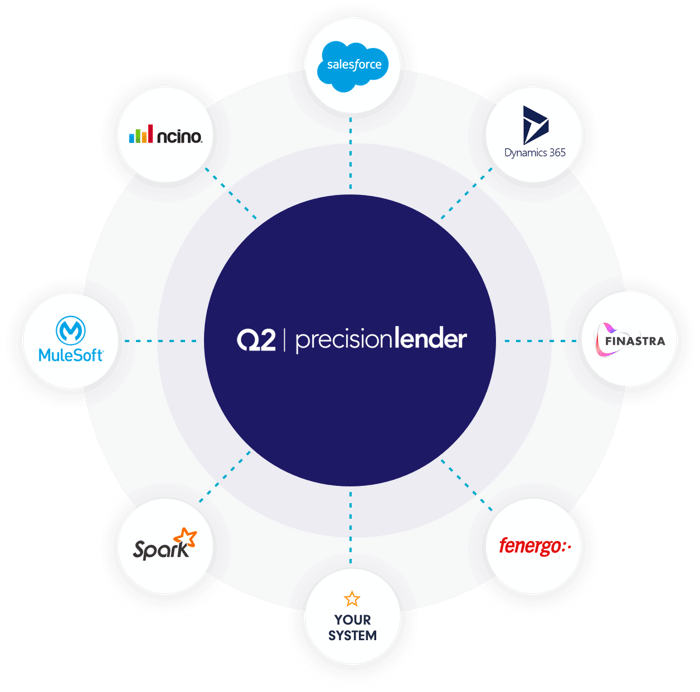

Extend your bank's technology impact

PrecisionLender is built upon a modern, open and secure API that enables easy integration with almost any other banking system.

Never lose a profitable relationship opportunity again

PrecisionLender Clients vs. the Competition (Year-over-Year)

Q2’s PrecisionLender Clients outperform their peers in all of these annual metrics*

*Based on FDIC numbers calculated year-over-year, from December 2022 - December 2023

-

“We're no longer just talking about this loan or that loan. We're talking about relationships and customers.”

Andy Max

Managing Director, First National Bank of Omaha -

“Before, they had a model that they used as something to complete a hurdle or get out of the way. Now they have a tool that can help them do their job.”

Rich Padula

Director of Finance